Written by:

Stay updated with Roku Advertising.

Executive Summary

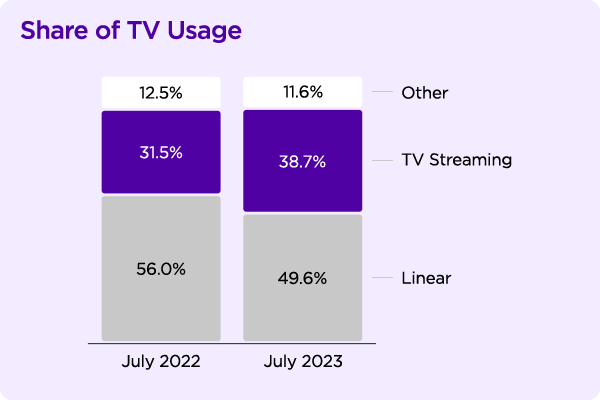

TV streaming reached an important milestone in 2023 as linear TV fell below 50% of total viewing in the US for the first time.1 Not surprisingly, this decline happened as the reach advertisers can achieve in streaming continues to break records.

Roku's mission is to connect and benefit the entire TV ecosystem, a mission we’re well-positioned to advance as the #1 TV streaming platform in the U.S.2 Our 75.8M active accounts and close partnerships with publishers and advertising partners around the world gives us a unique perspective on emerging trends that will impact the landscape in the coming year.

As we look to the coming 12 months, we predict the following:

1. Advertisers cut the cord.

2. Streaming heavyweights will focus on loyalty

3. A niche sport will break through to the mainstream.

4. Retail media and streaming build on each other’s momentum. Brands will lean on retail media partners to make their data more actionable.

5. Retailers develop shoppable storefronts for streaming campaigns.

Below, we present our 2024 predictions and analysis, which we hope will help guide you in the year ahead.

We wish you a happy, healthy, and prosperous 2024!

Kristina Shepard

VP, Global Advertising Sales and Partnerships

Roku

2. By hours streamed (Hypothesis Group: December 2022)

Prediction #1: Advertisers cut the cord

For decades, linear television was the tried-and-true channel for mass-market reach. But its relevance faded as audiences abandoned their pay TV packages in search of new content and more affordable services. Cord-cutting, which began as a trickle around 2007, has turned to a flood.

In July, linear TV dropped below 50% of total TV usage for the first time, while streaming reached a record high, at 38.7% of all TV usage.3 Furthermore, younger and even middle-aged audiences clearly prefer streaming. Seventy-four percent of adults under 50 streamed entertainment weekly during Q3 2023, compared to 62% who watched linear.4 And 18- to 34-year-olds haven't spent the majority of TV time on linear TV since February 2021.5

Today, many marketers still allocate large media budgets to linear TV. In 2024, however, we believe the tide will finally turn. On discovering that yesterday's linear TV assumptions no longer apply, they will embrace the power of TV streaming’s reach.

Streaming is the home of cultural touchstones. Additionally, while linear TV has historically been associated with big TV moments, brands increasingly view streaming as the home of memorable events, including major entertainment releases and sporting events like the World Cup. Streaming has become a popular co-viewing experience for sports, comedies, and even drama. In fact, households are more likely to co-view when watching connected TV (CTV) vs. linear—and they also pay more attention to CTV.6

With these changes in streamer behavior, many brands are reallocating portions of their linear TV budgets to streaming to reach consumers who are no longer on linear.

Even smaller advertisers can see big results. DTC luxury apparel brand Goodlife Clothing leveraged Roku’s self-service ad platform to reach new customers at scale. The brand achieved a 100%+ higher add-to-cart rate compared to other TV streaming platforms, and a 4x increase in campaign spending.7

In 2024, we expect advertisers to move more aggressively into streaming as they look for new ways to reach desired audiences.

3. Nielsen, August 2023

4. Internal Roku Data, 2023

5. Internal Roku Data, 2023

6. Television Viewing Habits Survey: August 2023

7. Internal Roku Data, Case study, Q4 2021; Campaign ran for 8 weeks

Prediction #2: Streaming heavyweights will focus on loyalty

2023 was a wild and unpredictable year for entertainment. After years of bullish investment in content and growth, the largest streaming services focused on profitability. At the same time, the actors' and writers' strikes disrupted production schedules. In light of these dynamics, we believe 2024 will see media companies emphasize audience loyalty and engagement with their content and IP across channels. They will also seek new ways to monetize existing content.

Let’s examine a few of their likely moves.

Activating the catalog.

First, streaming services will seek new ways to surface outstanding TV and movies in an environment of relative scarcity for new scripted content.8 The production dip of 2023 means viewers can catch up on the abundance of content produced in recent years. (The number of movies and TV shows available on streaming increased 39% in just two years).9

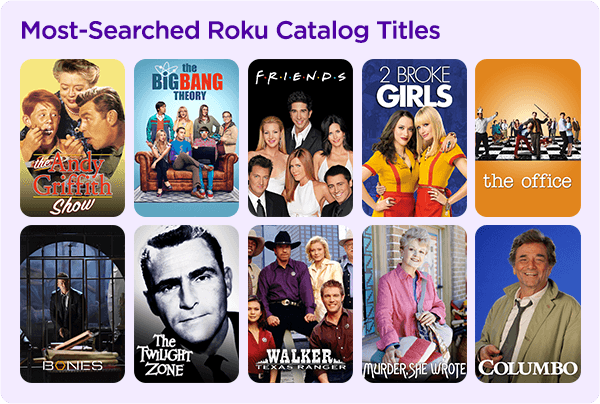

Roku data makes clear this older content is still gold. When streamers search for a series on Roku, the average query is for a title that is nearly 14 years old, and only 16% of series searches on Roku are for shows that currently air on broadcast TV.10

All that abundance had a downside: The average time it took to find something to watch topped 10 minutes, causing 20% of viewers to give up and do something else.11 This decision paralysis shows there’s a clear opportunity to promote beloved shows and help them rise above the noise.

Investing in ad growth.

In 2024, free ad-supported streaming television (FAST) channels will flourish as viewers catch up on content without breaking the bank.

FAST platforms like Pluto TV, a Paramount company, Tubi, and The Roku Channel have seen incredible growth during this period. Thus far in 2023, the YoY growth of FAST channel reach and engagement on Roku has outpaced that of the overall platform.12 We believe FAST channels will continue to be popular in 2024.

The big streaming services clearly see the momentum for FAST. In 2023, they fully leaned into their ad-supported tiers in a bid to boost revenue amid slower subscriber growth. The major services raised the prices of their SVOD offerings by 25% on average13 as they tried to migrate users to ad-supported tiers, which generate greater revenue per user.14

More openness to licensing.

Streaming services have long used their intellectual property as a carrot for new subscribers, requiring a subscription in order to watch a desired show. But as they pivot toward profitability, we predict some will take a more liberal approach to licensing. From one point of view, this is about retaining viewers regardless of where they stream. Importantly, media companies’ increased willingness to distribute shows off-platform will likely apply to some but not all of their content. The dynamic is not unlike the CPG and apparel industries, where many brands offer a selection of products on Amazon while selling the majority of inventory through direct-to-consumer and traditional retail channels.

In fact, this pivot has already begun: You can now watch Warner Bros.'s Dune and The Pacific on Netflix.

9. Gracenote Global Video Data; July 2021 and June 2023

10. Internal Roku Data, 2023

11. Nielsen Streaming Content Consumer Survey, June 2023

12. Internal Roku Data, 2023

13. Streamflation Is Here and Media Companies Are Betting You’ll Pay Up

14. Why Streaming Services Are Pushing Subscribers to Ad Tiers

Prediction #3: A niche sport will break through to the mainstream

Transformations are underway in the sports marketing arena.

Tier-one sporting events such as the Olympics and World Cup soccer have long been quintessential advertising opportunities prized by large advertisers. But these consumer tentpoles are extremely scarce, with limited advertising inventory that commands top dollar and sponsorship deals that are locked down years in advance.

Meanwhile on the consumer side, we see growing exasperation with the difficulty of finding sports. For example, Roku users are more confident that they can find where to watch a live NFL game on linear TV than where to stream one on Roku.15 And on average, Roku sports fans stream 43% more distinct sports channels than they did five years ago.16 People must now subscribe to multiple platforms to create something close to a comprehensive sports viewing experience.

Another factor that may be related to a growth in sports streaming viewership is the dip in premium scripted TV due to the actors’ and writers’ strikes of 2023 and streaming service pullback.17

In 2024, the high demand and significant pain points around discovery of sports content (for consumers) and sponsorship opportunities (for brands) will set the stage for niche sports to break through.

We've already seen several under-the-radar sports reach larger audiences in 2023. Women's College Basketball, for example, enjoyed 62% greater linear TV reach during March Madness compared to the prior year.18 We see a similar trend for the WNBA, which had 64% higher linear TV reach in June, its first full month of the season. Since then, linear TV reach for the WNBA in an average month has been 31% higher than in 2022.19

Households that searched for Netflix’s “Formula 1: Drive to Survive” series on Roku in the past year were 4.6x more likely than average to tune in to a Formula 1 Grand Prix race on linear TV in May 2023.20

Brands are recognizing the opportunities of underappreciated sports. In 2022, Ally Financial pledged to direct half of its media dollars to women’s sports to mark the 50th anniversary of Title IX, which prohibits discrimination based on sex.21

In the coming 12 months, sports like the WNBA, Formula 1, and sporting events like the Tour de France will increasingly find mass audiences in the US and around the world — and we expect one of them will break through in a big way, achieving audience reach on par with a tier-one event. And as the sports audience pie grows, new opportunities will emerge for smart advertisers to reach sports fans both on and off the gridiron.

Game on.

16. Internal Roku Data, 2023

17. Roku ACR data, Sept-October YoY (2022-2023)

18. Internal Roku Data, 2023

19. Internal Roku Data, 2023

20. Internal Roku Data, 2023

21. Ally pledges equality in media spend, issues bold call to action to further drive parity in women's sports

22. Washington Business Journal

23. Cheryl Cooky, Ph.D. Purdue University

Prediction #4: Retail media and streaming build on each other’s momentum. Brands will lean on retail media partners to make their data more actionable

Retail media and TV streaming are among the hottest channels in digital advertising today. But they are also highly fragmented.

For the second half of 2023, Insider Intelligence forecasted that US retail media ad spending would reach $46.3 billion. Meanwhile it estimated CTV ad spending would increase 21.2% for full-year 2023, surpassing $25 billion.24

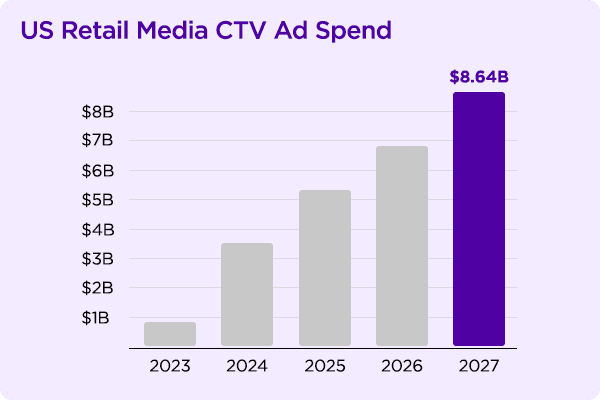

In 2024 and beyond, retail media and CTV will achieve new heights together. US retail media connected TV ad spend will reach $830 million in 2023, per Insider Intelligence, but will soar to $8.64 billion by the end of 2027.25 As a result, we believe more marketers will create dedicated retail and streaming media strategies to help them more easily leverage retail data sets in TV streaming.

For example, Red Baron joined Roku and KPM reach lapsed buyers with premium video streaming ads on the Roku platform. The two-month campaign drove a 9.1% uplift in household penetration, 48% increase in household penetration uplift among lapsed Red Baron buyers, and 6.9% sales uplift. Roku viewers exposed to the campaign spent 5x more on Red Baron.26

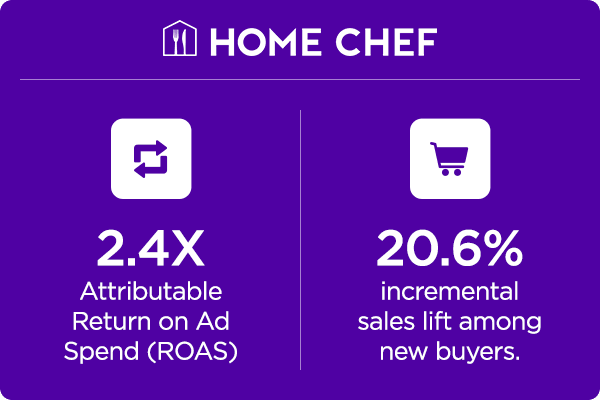

Additionally, HomeChef used KPM's shopper data to reach lapsed customers and in-market shoppers and measure performance after a streaming campaign on Roku. The campaign achieved a 2.4x return on ad spend, and delivered a 20.6% lift in sales amongst new buyers. Home Chef was able to recapture lapsed buyers and activate a new segment of meal kit customers.27

Addressing friction at the intersection of streaming and retail data

Many brands are excited to combine retail media and streaming ads, but find themselves held back by the data fragmentation and complexity involved. They don't want to buy ads or license data through 20 different retail media networks (RMNs) for a large campaign spanning streaming and digital media. Instead, they want to centrally manage it.

In 2024, we will see some misalignment between marketers who want to consolidate their retail media buys in the buying platforms of their choice and retailers who may be reluctant to license their data uncoupled from media transactions for business and privacy reasons.

Furthermore, buyers will ask that retail media networks integrate with streaming and other channels to drive full-funnel results. On average, 52% of streamers who purchased a product they saw advertised on Roku via Instacart were new to the brand – suggesting RMNs can compress the funnel and influence both early stage awareness and direct purchases in a short span of time.

While we have seen some retail media networks begin to open up in 2023, it’s not clear whether tier-one RMNs will be convinced to share more data for activation in third-party DSPs — at least in 2024. As long as their fledgling retail media businesses continue to grow by double-digits, the largest RMNs are likely to keep their first-party data close to the vest. But that may change by 2025 as growth slows and clean room technologies mitigate privacy concerns.

As in streaming, we expect the largest and most mature RMNs to continue operating successful standalone businesses, while the rest will join forces through co-ops and scaled networks.

25. Insider Intelligence | eMarketer, October 2023

26. Kroger Precision Marketing, 2022 | Campaign dates: Oct – Nov, 2022

27. Roku and Kroger Precision Marketing Data, 2021

Prediction #5: Retailers develop shoppable storefronts for streaming campaigns

Many of us are now used to buying products directly from social, mobile and display ads. While extending this behavior to the realm of TV streaming is a relatively recent development, we believe consumer shopping in TV streaming will grow in 2024.

We will see Roku Action Ads, QR codes, and shoppable TV overlays and even multi-product storefronts capable of quickly transporting a new wave of TV viewers from the top to the bottom of the advertising funnel.

Prognostications about e-commerce merging with TV are not new. In fact, we as an industry have been flirting with the promise of actionable TV ads for more than 20 years. Marketers were sold on the vision that we could use our remote controls to buy Jennifer Aniston’s sweater while watching Friends. Back then, some predicted that by 2005, Americans would spend $4.3 billion a year shopping with their remotes, but those predictions were premature.28 Neither the tech nor the economics were in place for shoppable TV advertising to reach its inflection point...until now.

In 2023, the promise of shoppable ads has become a reality. Pinterest is making every pin on its platform shoppable, while TikTok livestreams enable users to add products directly to their shopping carts.29 And Roku, with our leading scale, is driving the same behaviors in TV streaming.

Last year, Walmart and Roku teamed up to connect advertisers with consumers through Action Ads across the streamer’s journey. In a recent campaign, Roku’s shoppable ads made it easy for users to buy Walmart products chosen by football quarterback Patrick Mahomes, global superstar Becky G, and fictional but fabulous Barbie, who is apparently a pickleball fan.

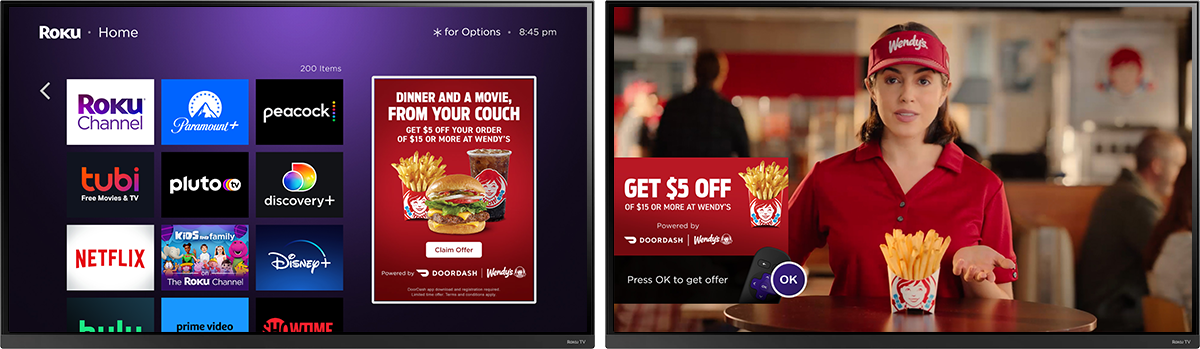

Additionally, shoppable ads have made dinner and a movie easier than ever. Through a Roku-DoorDash integration, a Wendy's campaign on Roku offered $5 off orders of $15 or more. Roku viewers who clicked on the ad received a text message with a deep link to the Wendy’s storefront in the DoorDash app.

The campaign boosted Wendy’s average order value by 11% over non-exposed customers, and total sales were 57% higher than a campaign without DoorDash elements. Furthermore, almost half of orders came from new or lapsed Wendy’s DoorDash customers. Even better, 78% of the audience reached by the ads never saw the campaign on linear, underscoring the value of streaming advertising.30

With best practices and consumer adoption now well established, 2024 will be a growth year for shoppable TV. Grab your remote.

29. Insider Intelligence

30. Internal Roku Data, 2023 | Campaign dates: Jan – Mar, 2023

Conclusion

The streaming market will continue to evolve and mature over the next 12 months. In 2024, streaming advertisers will embrace exciting new opportunities — across ad-supported streaming, sports, retail media and other pillars — to reach their desired audiences at scale with data-driven precision and creative impact that surpasses linear TV. Indeed, we’ve only just scratched the surface of what’s possible in streaming.

With our scale, performance, and storytelling capabilities, Roku is singly focused on making brands unmissable across the entire TV streaming journey.

We look forward to using our data and insights to help you navigate the streaming landscape in 2024 and beyond.

Forward-Looking Statements

The foregoing contains “forward-looking” statements that are based on our beliefs and assumptions and on information currently available to us on the date of publication of this article. Forward-looking statements are not historical facts, and include statements relating to, among other things, predictions relating to advertising developments in 2024. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future.